Voiding a check is a fundamental financial skill that, while simple, is essential for managing your banking and personal finance tasks effectively. Whether you’re setting up direct deposit, making a payment that requires a voided check, or correcting a mistake on a check, knowing how to properly void it is crucial. This article will provide a comprehensive guide on how to void a check, including when you might need to do so, the steps involved, and tips to ensure your financial security throughout the process.

Understanding the Basics of a Voided Check

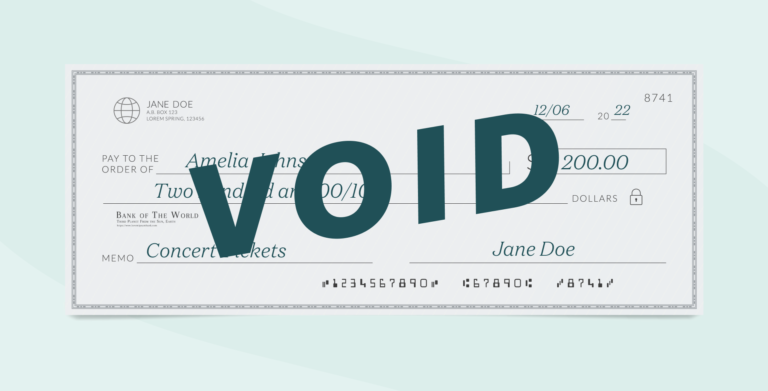

Before diving into the “how-to” aspect, it’s essential to grasp what a voided check is and its purpose. A voided check is a check that has the word “VOID” written across the front, indicating that it cannot be used to make a payment. The check’s banking information, however, remains visible and can be used to set up electronic links to your bank account. This makes voided checks a common requirement for setting up direct deposits, automatic payments, or electronic transfers.

When You Might Need to Void a Check

Setting Up Direct Deposit

One of the most common reasons for voiding a check is to set up direct deposit with your employer. Direct deposit allows your paycheck to be automatically deposited into your bank account, requiring your account number and bank routing number—details readily available on a voided check.

Automatic Bill Payments

Similar to direct deposit, setting up automatic bill payments to utilities, credit cards, or mortgage lenders often requires a voided check. This facilitates the monthly withdrawal of payments directly from your checking account.

Correcting Mistakes

If you make an error while writing a check—such as writing the wrong amount or payee name—voiding the check is a secure way to ensure it can’t be used while you write a new one.

How to Void a Check: Step-by-Step

Voiding a check is straightforward, but it’s important to do it correctly to prevent potential fraud or misuse.

- Start with a Clean, Unused Check: Ensure the check you’re about to void is clean and hasn’t been used before. If you’re correcting a mistake, make sure it’s the check with the error.

- Write “VOID” Across the Front: Use a black or blue pen to write “VOID” in large letters across the front of the check. Make sure the letters are bold and legible, but don’t cover the check’s numbers at the bottom. These include your account number and the bank’s routing number, which are necessary for setting up electronic payments.

- Record the Voided Check: Note the check number and the date you voided it in your check register. This helps keep your financial records in order and prevents confusion about your check sequence or account balance.

- Communicate with the Relevant Parties: If you’re voiding the check for a specific purpose, like setting up direct deposit, inform the relevant party that the check has been voided and is ready for use. If you voided the check to correct a mistake, ensure you write a new check for the correct amount or payee.

- Store or Dispose of the Voided Check Securely: If the voided check is not being immediately used for setting up electronic payments, store it securely with your financial records. If it’s no longer needed, shred it to prevent any possibility of fraudulent use.

Tips for Ensuring Your Financial Security

- Never Leave Blank Checks Unattended: A blank check is a potential target for fraud. Always keep your checkbook in a secure location.

- Use Digital Options When Possible: Many financial transactions can now be completed online or via mobile apps. These options often provide greater security and convenience than traditional checks.

- Regularly Monitor Your Bank Account: Keep an eye on your bank statements and transaction history. Early detection of any unauthorized transactions can prevent further financial damage.

- Consider Alternative Methods for Voiding Checks: If you don’t have physical checks or prefer not to use them, inquire with your bank about other methods for providing your account information, such as preprinted voided checks or direct forms.

Conclusion

Knowing how to void a check is a simple yet essential skill in personal finance management. Whether you’re setting up direct deposit, automatic payments, or correcting a mistake, the ability to properly void a check ensures smooth financial transactions and enhances your security. By following the steps outlined above and adhering to best practices for financial security, you can confidently manage this aspect of your banking tasks. Always remember to monitor your accounts regularly and opt for digital financial management tools when available, as they offer convenience and an added layer of security.

FAQs on How to Void a Check

1. What does it mean to void a check?

Voiding a check means writing the word “VOID” across the front of the check to prevent it from being used for payment. The check can no longer be cashed or deposited, but the banking information on it remains visible and usable for setting up electronic payments or direct deposits.

2. Can I void a check after it has been written out?

Yes, you can void a check after it has been written out. If you make a mistake or no longer need the check for its original purpose, simply write “VOID” in large letters across the front. Remember to record the voided check in your check register for accurate financial records.

3. How do I safely dispose of a voided check?

If you do not need to keep the voided check for setting up electronic payments, it’s best to shred it. Shredding the check ensures that the banking information cannot be used fraudulently. If you don’t have a shredder, cutting it up into small pieces, especially targeting the account and routing numbers, is a good alternative.